The NBS Archives are open to the public at the following times:

Tuesday, Wednesday and Thursday

9 a.m. to 12 noon /

12:45 p.m. to 3 p.m.

In July, August and September the Archives are closed to the public.

Pomocná pokladnica, Stará Turá

Pomocná pokladnica (Mutual Treasury), Stará Turá was established in 1871 in the form of a local cooperative-type financial institute. The reason for its establishment was the difficult social situation and the need to improve conditions for the development of commerce and trades in the town and its vicinity.

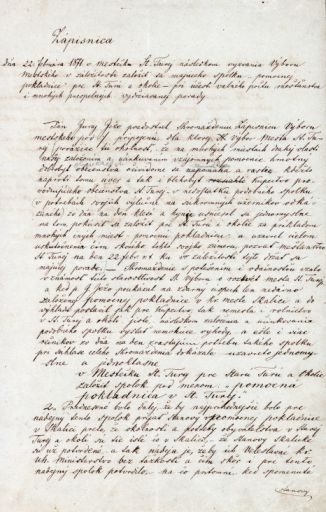

The initiative for the establishment of a financial institute came from the town council, inspired by neighbouring towns, notably Skalica. At its initiative, a meeting took place on 22 February 1871 at which a decision was made to establish a financial association. The meeting set the date of the founding general meeting on 5 March 1871, being also the official date of the establishment of Pomocná pokladnica. The obstacles that Slovak financial institutions had to cope with as part of the approval process made the inhabitants of Stará Turá use for their association the statutes of the Skalica Mutual Treasury which have already been approved. An important reason for this solution was the fact that all their provisions were in accordance with the needs and possibilities of the local population.

The initiative for the establishment of a financial institute came from the town council, inspired by neighbouring towns, notably Skalica. At its initiative, a meeting took place on 22 February 1871 at which a decision was made to establish a financial association. The meeting set the date of the founding general meeting on 5 March 1871, being also the official date of the establishment of Pomocná pokladnica. The obstacles that Slovak financial institutions had to cope with as part of the approval process made the inhabitants of Stará Turá use for their association the statutes of the Skalica Mutual Treasury which have already been approved. An important reason for this solution was the fact that all their provisions were in accordance with the needs and possibilities of the local population.

Under the statutes, each adult of good repute regardless of their status, profession, sex or faith could become member of the association. Shareholders could be directly involved in the economic and overall operation of the institute through general meetings with voting right for each share owned up to a maximum of 10 votes. A member’s share was worth 60 guldens with a payment over a period of up to 10 years in the form of monthly deposits of approximately 50 kreuzers. It could also be paid as a single instalment or in higher instalments depending on the owner’s financial situation. The number of shares owned by one person was unlimited. Besides these deposits, another important source of financing for the association came from extraordinary deposits, which could be made also by non-members, but their sum could not exceed the value of the shareholders’ savings.

Pomocná pokladnica was the most accessible form of saving for a wide section of the population, for whom it was also the most accessible source of necessary capital. Funds were provided in return for promissory notes, which had to be signed by the applicant and one guarantor residing directly in Stará Turá. The maximum amount, interest rates and maturity of loans were set by the general meeting depending on the association’s financial performance and the overall economic situation in the country.

As a sufficient amount of saving deposits was fundamental to the successful provision of loans, Pomocná pokladnica paid special attention to acquisition activities. It promoted the idea of saving practice throughout the region through a sophisticated network of agents. For this purpose, there were also “anniversary books” issued in 1920s by the organisation at its various significant occasions, with 10 crown deposits from the management. The anniversary books were awarded to successful local students. Their purpose was to engrave the practice of saving in children’s mind from an early age.

Potential debts of Pomocná pokladnica were secured with the members’ private property. The statutes of 1935 determined the scope of accountability to twice the value of shares, and members’ liability to the institute continued one year after the date of their membership’s termination.

Until 1926, the institute did not have any organisational headquarters and it was supervised by its own management members who were elected for this purpose. A resolution of the general meeting that took place on 14 March 1926 was a significant milestone as it made Pomocná pokladnica a member of Ústredné družstvo (Central Cooperative) in Bratislava and thus it became formally a cooperative. Ústredné družstvo, as a superior body, guided the organisation, methodology and operation of Pomocná pokladnica and annually reviewed its management and compliance with the statutes.

Although Pomocná pokladnica was intended to operate for only 10 years, thanks to its prosperity and remarkable social and economic gains for individuals and the whole region, it eventually survived for 76 years. Thanks to prudential and careful management, the institute overcame years of crises, economic turbulence, political and constitutional changes without significant harm during this period. Even the internal crisis at the beginning of 1902, which made a part of the old members leave the association and establish a competitive institute called Staroturanský úverný spolok, účastinná spoločnosť, did not shake its existence. Pomocná pokladnica also managed to avert the threats of liquidation represented in 1919 and more intensely in 1944 by the concentration process in banking, which involved plans for its merger with a local credit institution. A completely new situation developed after 1945, with wide-ranging measures in the financial system that significantly affected the Slovak people’s banking structure and ultimately resulted in the creation of a new, uniform type of financial institution. The measures affected Pomocná pokladnica in Stará Turá in 1948, based on the notice of the Executive Authority for Finance No 13212/48-VI/18, which ordered it to merge with Občiansky úverný ústav. As a result, Sporiteľňa a pokladnica (Savings Bank and Treasury) was established in Stará Turá. The last meeting of the management took place on 31 August 1948 and that is also the last record concerning the activities of this cooperative financial institute.

The archival material of the institute was moved in a disordered condition to the corporate archive of Štátna banka československá in Marianka. The fonds was processed and an inventory was made in 1964. In 2015, the fonds inventory was checked and corrected in the NBS Archives.

The archival fonds may be used to study the activities of mutual tresuries in Slovakia, and to study the effects of the mutual tresury on economic life in the town of Stará Turá and its vicinity.